Tax incentives come and go every year, but one big federal tax credit that will be around for the next few years is saving some companies a TON of money.

In 2018, a new tax amendment allowed companies to expense heating, ventilating, and air conditioning systems for the first time. This new tax amendment offers businesses a 10% federal tax credit on these systems. You can use this credit on new systems, retrofits, or even a hybrid system. In addition to the equipment costs, all costs associated with installs are also eligible for this tax break. This includes piping, labor, air handlers, ducting, etc.

And not only does this incentive impact HVACs, but it also extends to geothermal systems and geothermal upgrades!

The Big Change to Accelerated Depreciation

Additionally, these systems are capable of being depreciated over a much shorter period. In most cases, you can depreciate the equipment in a single year as opposed to over a 39 year period (which is standard for most heating and cooling systems.) This can result in a significant impact on first-year cash flow and project return on investment!

The depreciation with MACRS provides an additional tax saving up to 24.7% of the energy basis over the first five years, compared to the 39-year plans that have a 3.33% tax savings. Ultimately, this means you save money.

Still Confused?

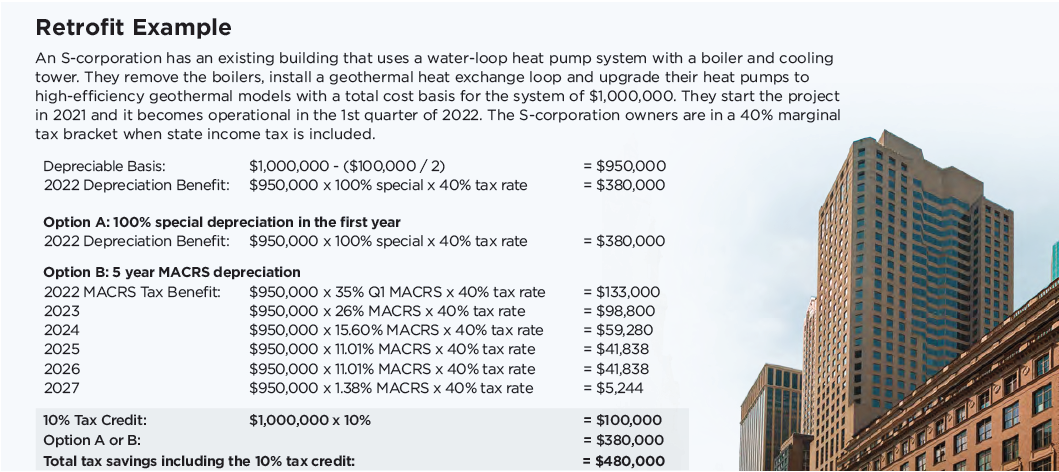

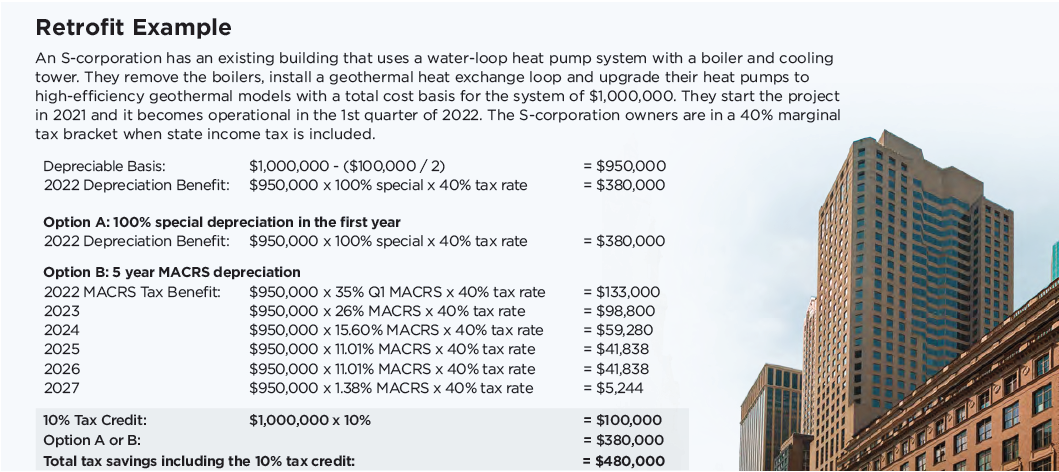

Here’s an example:

**Photo Credit to “Federal Tax Incentives” article written by Water Furnace Commercial Solutions.

That’s a total tax savings of $480,000 on a 1 million dollar project! Talk about a significant savings!

Who’s Eligible and Who’s Not?

Who’s eligible:

The incentive requires that your structure is located in the US. It also states that only the owner can claim tax credits or the depreciation deductions. Construction must begin before 2022, and the system must be used to heat and cool your building.

Who’s not:

If you’re spending on equipment used for anything other than space conditioning, or on equipment that’s used by tax-exempt organizations, you’re not eligible. If you’re not sure if this is you, give us a call, and we’ll walk you through it!

Take Advantage Of This Tax Amendment

Let the pros at Rasmussen Mechanical point you in the right direction to make smart financial decisions about your facilities. Give us a call at 800-237-3141 or shoot us an email if you have any questions.